- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

Understanding Basics of Margin Trading, How Does Margin Trading Works? and It's Benefits

By HDFC SKY | Updated at: May 25, 2025 09:46 PM IST

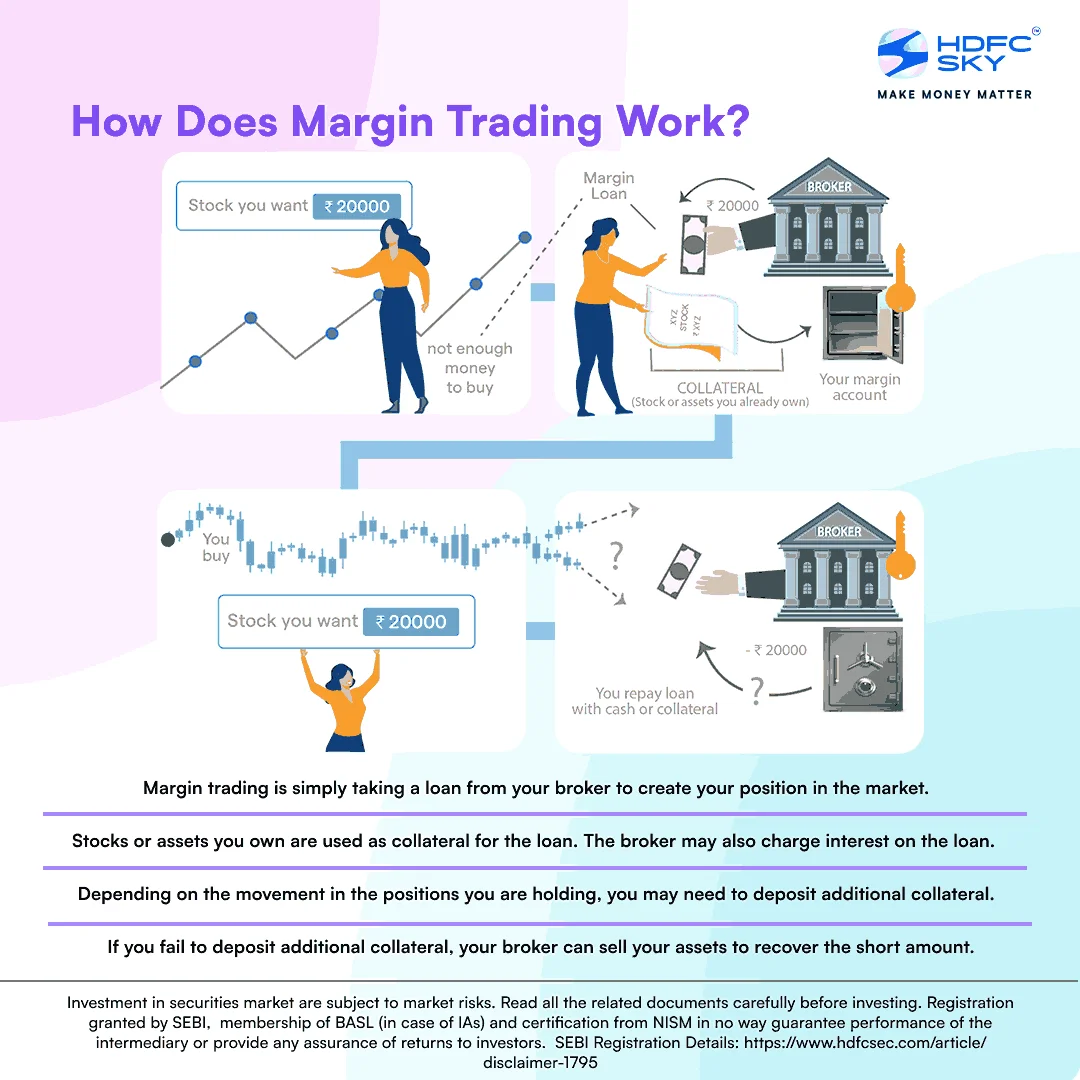

Stock market traders generally trade depending upon the funds available with them. However, traders can also buy stocks more than they can afford. They can do this with the help of brokers. Some brokers lend cash to traders or investors to make transactions in the market. This type of trading in the stock market with the help of borrowed money from brokers is called Margin Trading.

Stockbrokers offer margin trading facilities to traders, helping them with access to higher capital for investment. The funds lent by brokers are used by traders to trade more than they can afford and increase the possible returns. This borrowed amount is then settled by investors after they square off their position.

Margin trading generally involves both intraday and positional trading. Traders pay only a small portion of the total value of the stock purchased or sold, called margin, while the stockbroker lends the rest of the amount. Brokers lend the money to buy shares and keep them as collateral.

The investors make real profits only when the total amount earned is more than the margin provided by the brokers. This makes margin trading risky for small traders.

How does margin trading work?

As a trader, you need to open demat account with Margin Trading Facility (MTF) with your broker to invest through margin trading. It is a type of brokerage account in which the brokers disburse the funds to you for trading.

You will need to keep a minimum balance in the MTF accounts called minimum margin. This minimum margin can be in the form of cash or securities purchased, which is used as collateral to avail loan from the broker. The brokers also charge a certain amount of interest on the loan amount. This minimum balance and the rate of interest vary from broker to broker.

For instance, let’s suppose you want to purchase 100 shares of Company A at Rs 500 per share. You will require a total investment of Rs 50,000 if you want to pay for it in full. But, if you avail the margin trading facility and if the margin is 25%, you will have to pay only 25% of Rs 50,000 I.e., Rs 12,500. The rest of the amount will be loaned by the broker on which interest will be levied.

Now, if the stock price rises, you will earn higher return as your initial investment is low. But, if the stock price falls drastically, you will also incur higher losses.

Brokers levy interest on the funds given through MTF accounts. This increases your cost of purchasing securities. This interest that is charged as long as the loan amount remains outstanding. Hence, you cannot make profits if the shares purchased through margin funding do not appreciate in value or may even incur heavy losses if the value of the shares declines.

Advantages

Margin trading is useful if you want to trade in large positions. It involves taking large positions with a small amount of investment. You require a relatively small investment for taking a large positions in the market as the balance is paid by the broker in terms of a loan. This magnifies any gains from the trades.

You can make huge bets with the high exposure in the market. A requirement of only a small portion of the total amount to buy stocks helps you make frequent trades and trade in a large number of stocks. This increases coverage in the market by adding positions in the larger pool of stocks with margin trading.

Risks in margin trading

Though margin trading gives you higher returns, it also comes with higher risks. It is essential for you to understand the risks involved and develop an appropriate risk management strategy before taking positions in margin trading.

You need to maintain a minimum balance in your MTF account as mandated by the brokers. You may have to deposit more cash or sell your shares if the balance falls below the prescribed limit.

As the trades are done with borrowed funds in the margin trading, it includes interest costs. This increases the costs of acquiring stocks. The interest cost is fixed and it must be paid irrespective of the gains or losses in the purchased stocks. The interest levied does not depend upon the increase or decrease in the stock price.

Margin trading also comes with a risk of liquidation of assets in MTF accounts in case of dishonoring the margin call. There is a possibility that you may incur heavy losses if the price of the shares purchased through margin funding falls heavily. Here, the broker may make a margin call, wherein you will need to put more collateral or cash in the MTF account. If the collateral is in the form of shares, their value decreases, the broker will make a margin call.

If you fail to pay the margin call, the broker has the right to square off the position at a loss or liquidate the assets in the MTF account to recover his losses.

Thus, margin trading, along with high returns, also brings high risks and you need to trade as per your risk appetite.