- Offerings

- Tools & Platforms

Tools & Calculators

- Open API

- Calculators

- SIP Calculator

- CAGR Calculator

- Compound Interest Calculator

- FD Calculator

- RD Calculator

- EPF Calculator

- Retirement Calculator

- HDFC SIP Calculator

- Mutual Fund Return Calculator

- Lumpsum Calculator

- Step Up SIP Calculator

- ETF SIP Calculator

- Brokerage Calculator

- Equity Margin Calculator

- SWP Calculator

- EMI Calculator

- MTF Calculator

- Pricing

- SKY Learn

- Mutual Funds

- Margin Trading

- Financial Planning

- Personal Finance

- Share Trading

- IPO

- Derivatives

- Currencies

- Intraday Trading

- Trading Strategies

- Demat Account

- Commodity

- ETF

- Understanding Commodity Market Trading in India

- How to Start Commodity Trading

- Types of Commodities

- How Do You Invest in Commodities?

- How To Trade a Commodity?

- Strategies for Commodity Trading

- Ways To Trade Commodities During Inflation

- Benefits of Commodity Trading

- Risks of Commodity Trading

- Start Trading in Commodity with HDFC Sky

- Conclusion

- FAQs on How To Trade in Commodities Market?

- Understanding Commodity Market Trading in India

- How to Start Commodity Trading

- Types of Commodities

- How Do You Invest in Commodities?

- How To Trade a Commodity?

- Strategies for Commodity Trading

- Ways To Trade Commodities During Inflation

- Benefits of Commodity Trading

- Risks of Commodity Trading

- Start Trading in Commodity with HDFC Sky

- Conclusion

- FAQs on How To Trade in Commodities Market?

How to Trade in Commodity Market in India? Know Benefits & Risks Commodity Trading

By Shishta Dutta | Updated at: Oct 24, 2025 06:02 PM IST

Trading in the commodity market involves buying and selling raw materials like gold, oil or agricultural products through exchanges such as MCX or NCDEX. It offers investors opportunities to diversify portfolios, hedge risks and potentially earn profits based on price movements of these commodities. Understanding how the market works, the types of commodities available and the trading strategies involved is crucial before entering this dynamic segment.

Understanding Commodity Market Trading in India

The commodity market in India is supervised by the Securities and Exchange Board of India (SEBI), which enforces compliance with laws and guidelines laid down by the Ministry of Finance. The two major exchanges that facilitate the trading of commodities are the Multi Commodity Exchange (MCX) and the National Commodity and Derivatives Exchange (NCDEX). These exchanges are a platform for buyers and sellers to execute trading contracts, which are agreements to trade in a particular quantity of a commodity at a predetermined rate for a future date.

Trading in the commodity market is divided into two kinds of contracts: spot contracts and futures contracts. Spot contracts deliver commodities in real-time, while futures contracts permit traders to buy or sell commodities at a future date. Grasping this difference between the two contracts is vital when learning how to invest in commodity market. Options on commodity futures contracts are also offered at MCX.

How to Start Commodity Trading

To start commodity trading in India, follow these steps:

- Choose a Registered Broker: Select a SEBI-registered broker offering access to commodity exchanges like MCX or NCDEX.

- Open a Commodity Trading Account: Submit KYC documents to open a trading and demat account.

- Understand the Market: Learn about different commodities, contract types and market timings.

- Deposit Margin Money: Fund your account with the required margin to begin trading.

- Use a Trading Platform: Log in to the broker’s platform to analyse charts, place orders and track performance.

- Start with a Strategy: Begin trading with a clear plan and risk management rules.

Types of Commodities

Commodities are broadly classified into categories based on their nature and usage. Here are the main types:

- Agricultural Commodities:

- Examples: Wheat, rice, cotton, sugar, coffee

- Traded based on harvest, demand and weather patterns

- Energy Commodities:

- Examples: Crude oil, natural gas, coal

- Sensitive to geopolitical tensions and global demand

- Metal Commodities:

- Precious Metals: Gold, silver, platinum (used for investment and jewelry)

- Base Metals: Copper, aluminum, zinc (used in industry and construction)

- Livestock and Meat:

- Examples: Live cattle, pork bellies, feeder cattle

- Prices depend on feed costs, disease outbreaks and demand

These categories help traders and investors diversify their portfolios based on risk and sector performance.

How Do You Invest in Commodities?

You can invest in commodities in the following ways:

- Commodity Futures: Trade contracts to buy/sell commodities at a future date via exchanges like MCX.

- Commodity ETFs/Mutual Funds: Invest indirectly in commodities like gold, oil or agriculture through professionally managed funds.

- Spot Market: Buy physical commodities like gold or silver directly from the market.

- Commodity Stocks: Invest in shares of companies involved in commodity production (e.g., oil, mining).

- Sovereign Gold Bonds (SGBs): Government-issued bonds linked to gold prices, offering interest and long-term investment benefits.

Choose based on your risk appetite, investment goals and market knowledge.

How To Trade a Commodity?

Here’s how to trade a commodity in India:

- Open a Commodity Trading Account: Register with a SEBI-registered broker and link it with your demat and bank account.

- Choose an Exchange: Trade through platforms like MCX (Multi Commodity Exchange) or NCDEX (National Commodity & Derivatives Exchange).

- Research the Commodity: Understand supply-demand, seasonality, global trends and geopolitical factors affecting the commodity.

- Select the Commodity: Choose from metals, energy, agri-commodities, etc., based on your interest and risk tolerance.

- Place Your Order: Choose futures or options contracts, set your price and execute the trade online via the broker’s platform.

- Monitor and Manage Risk: Use stop-loss orders and track price movements regularly.

- Settle the Trade: Either square off the position before expiry or opt for physical/financial delivery (as per contract type).

Strategies for Commodity Trading

Commodity trading requires a mix of market knowledge, timing and risk management. Strategic planning helps maximise returns while minimising risks.

- Trend Following: Identify and trade in the direction of the prevailing trend using technical indicators.

- Range Trading: Buy at support and sell at resistance in a sideways market.

- Breakout Trading: Enter trades when prices break out of key support/resistance levels.

- Seasonal Trading: Capitalise on predictable seasonal demand/supply cycles, especially in agri-commodities.

- Hedging: Protect against price fluctuations by taking offsetting positions.

- Fundamental Analysis: Base trades on economic reports, inventory data, weather patterns, etc.

- Spreads: Use inter-commodity or intra-commodity spreads to limit risk and capture relative price movements.

Ways To Trade Commodities During Inflation

Inflation can strongly impact commodity price actions, so understanding how to invest in commodities during such times is crucial. Traders often use hedging as a trading strategy during inflation. Hedging means taking offsetting positions to mitigate or eliminate the risk of adverse price movement.

Commodities like gold and silver are considered safe bets during inflationary times, as they tend to maintain their value comparatively better than other commodities. Investing in these safe bets can protect your portfolio against the risk of capital depletion during inflation.

Energy commodities like crude oil and natural gas may show price spikes during inflationary times.

Benefits of Commodity Trading

Commodity trading offers investors a unique way to diversify their portfolio and hedge against inflation. It also provides opportunities for high returns.

- Diversification: Reduces risk by adding non-correlated assets to your portfolio.

- Hedge Against Inflation: Commodity prices often rise with inflation, offering protection.

- Liquidity: Popular commodities like gold, crude oil and silver are highly liquid.

- Leverage: Traders can take larger positions with a smaller capital outlay.

- Transparency: Regulated exchanges like MCX and NCDEX ensure fair pricing and trade execution.

- Global Exposure: Allows participation in international price movements and demand-supply dynamics.

- Speculation Opportunities: Offers short-term trading opportunities based on market trends.

- Price Determination: Helps producers and consumers determine fair market prices.

Risks of Commodity Trading

Commodity trading can be profitable but also carries significant risks due to market volatility and external factors. Traders must be cautious and informed.

- High Volatility: Prices can fluctuate sharply due to global demand, supply and geopolitical events.

- Leverage Risk: While leverage increases profit potential, it also amplifies losses.

- Market Uncertainty: Weather conditions, natural disasters or political unrest can affect prices.

- Lack of Information: Inadequate market knowledge can lead to poor trading decisions.

- Liquidity Risk: Some commodities may have low trading volumes, making it hard to exit positions.

- Regulatory Risk: Sudden changes in government policies or taxation can impact the market.

- Emotional Trading: Greed and fear can lead to irrational decisions and heavy losses.

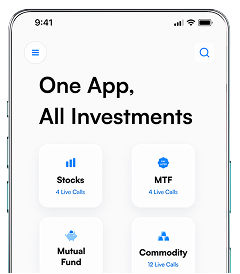

Start Trading in Commodity with HDFC Sky

Commodity trading gives traders, investors and producers of commodities the opportunity to hedge their risks and also take advantage of favourable market movements. Open Demat account with HDFC Sky and get access to commodity exchanges. HDFC Sky offers you research & insights too so that you make informed commodity trading decisions. ( Currently, do not offer Intraday Orders in MCX, however, you can buy and sell in ‘Normal’ category on the same day, if required )

Conclusion

Commodity trading offers excellent opportunities for diversification, inflation hedging and profit through price movements. However it also comes with inherent risks like volatility, leverage exposure and market unpredictability. To succeed, traders must understand market dynamics, use proven strategies and apply disciplined risk management. With the right knowledge and approach, commodity trading can be a valuable addition to your overall investment plan.

Related Articles

FAQs on How To Trade in Commodities Market?

How is Commodity Trading Different from Equity Trading?

Commodity trading involves buying and selling raw materials like gold, oil, or agricultural products, while equity trading deals with shares of companies. Commodities are influenced by global supply-demand factors and geopolitical events, whereas equities depend on a company’s performance and market sentiment. Also, commodities are usually traded in futures contracts, while equities are traded as stocks in the cash market.

Do I Need a Special License to Trade Commodities?

No, commodity trading does not require a special license. You just need to open a trading account with a broker that offers you access to commodity exchanges.

Can I Trade Commodities Online?

Yes, commodities can be traded online on the commodities trading platform of your broker.

What Are the Tax Implications of Trading Commodities?

Profits from trading commodities are liable to capital gains tax in India. The trade duration determines whether the gain falls under the long-term or short-term capital gains tax category.

What Is the Role of Leverage in Commodity Trading?

Leverage allows you to take a larger position in a commodity than what your own capital will allow. Leveraging is a double-edged sword. It can give profits but also amplify losses.

How Does the Settlement Process Work in Commodity Trading?

In commodity trading, settlement means delivering the contracts by exchanging ownership of the physical commodity for spot contracts or settling the adjustment in value in cash for a futures contract on the expiry date.